With the recent passing of a $2 trillion U.S. stimulus package, small business owners impacted by COVID-19 have been given options for low-interest loans, financial assistance, and other aid that can help them in this uncertain economic time.

Aside from this stimulus package, a number of private, state and local institutions have also stepped up to provide aid, assistance, and loans to small business owners suddenly facing unforeseen challenges.

With a number of different options emerging, small business owners might be asking themselves, "Which options am I eligible for?" and "Which funding option is right for my particular business?"

To help business owners and entrepreneurs looking for financing options, we've compiled a list of public and private opportunities for small businesses.

National Funding Resources for Small Businesses

Small Business Administration

The Small Business Administration is a federally funded organization that provides loans, debt relief, and other financial aid to small businesses with 500 employees or less.

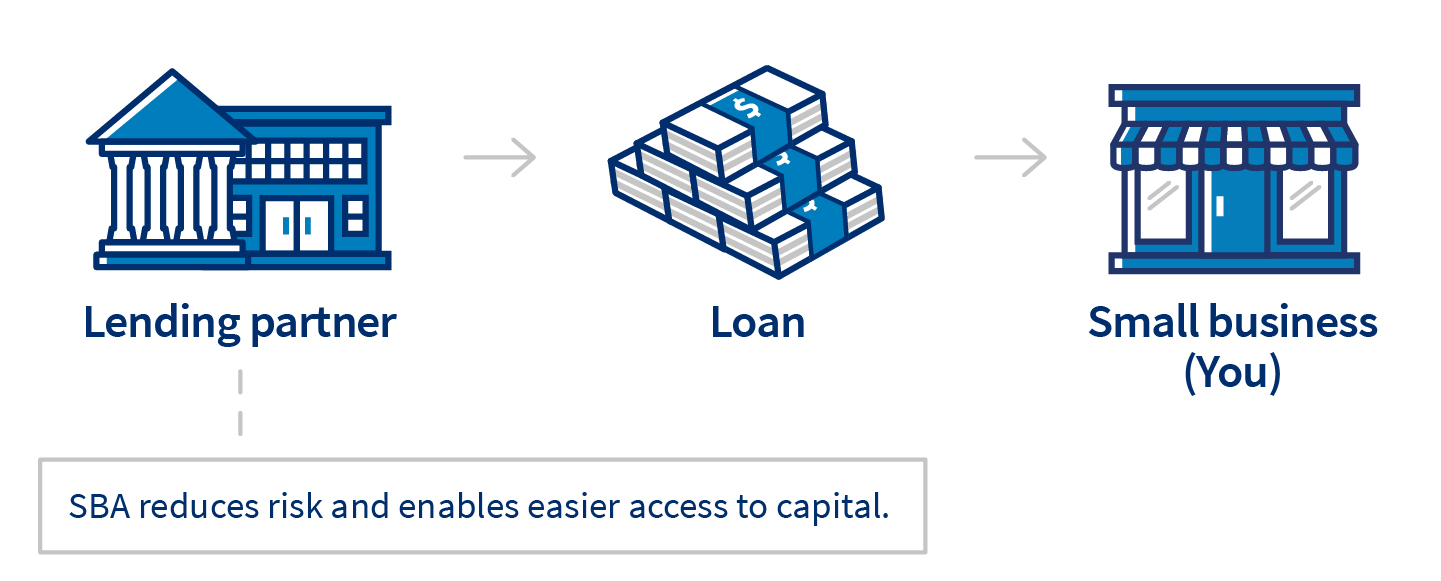

Currently, the Small Business Administration oversees small business loans from SBA-approved lenders, such as banks. While SBA doesn’t lend money directly to small business owners, it sets guidelines for loans made by its partnering lenders, community development organizations, and micro-lending institutions. This process reduces the risk for lenders, which -- in turn -- enables more small businesses to receive loans.

Here are a few examples of loans that the Small Business Administration coordinates:

Paycheck Protection Program

This program provides low-interest loans of up to $10 million funded by the recently passed CARES Act. These loans aim to prevent the financial downturn of small businesses impacted by COVID-19. The program assists business owners in paying employee payroll, mortgage payments, or other vital business expenses.

According to the SBA's site, up to 100% of the loan is forgivable and partial forgiveness will be granted if all employees stay on the payroll for eight weeks or more after a business receives the loan.

Economic Injury Loan Assistance

As part of another emergency preparedness act, small businesses impacted by COVID-19 can apply on the SBA site for a low-interest disaster loan of up to $2 million. Applicants will receive a decision about their loan within three days of applying.

These low-interest loans will have a payback period of up to 30 years, determined by lenders on a case-by-case basis. Each loan's interest rate will be 2.75% for non-profits and 3.75% for other small businesses.

Standard 7(a) Small Business Loans

The 7(a) loan program is the SBA's primary program for small businesses. The terms and conditions, like the guarantee percentage and loan amount, vary by the type of loan. These small business loans are often used for smaller startup business costs and are not related to emergencies or disasters.

The 7(a) loan size is usually between $350,000 and $5 million. Lenders are not required to take collateral for loans up to $25,000. For loans over $350,000, the SBA requires a lender to accept as much collateral as possible. This collateral could include a business' fixed assets, trading assets, or real estate.

Express Small Business Loans

Express loans are similar to 7(a) Small Business Loans in that they max at $350,000 and will require lender collateral. The key difference is that applicants will get a decision and disbursement within 36 hours of applying for the loan. Like other SBA loans, the lender determines the eligibility and the loan's terms.

For more urgent loans, exporters can apply for an Export Express loan. Applications for these loans, which cap at $500,000, will get a response from lenders within 24 hours.

Aside from the loans mentioned above, SBA also offers assistance for veterans, businesses that require short-term seasonal loans, and small businesses that need loans for international trading purposes.

You can find more about SBA's standard loan programs here. On the SBA website, you can also find information about SBA lenders.

While SBA primarily provides loans, the administration also works with organizations to provide grants to businesses in certain fields, such as scientific research and development and exporting. Information about these specific grant opportunities can be found on the SBA's grant page.

Grants.gov

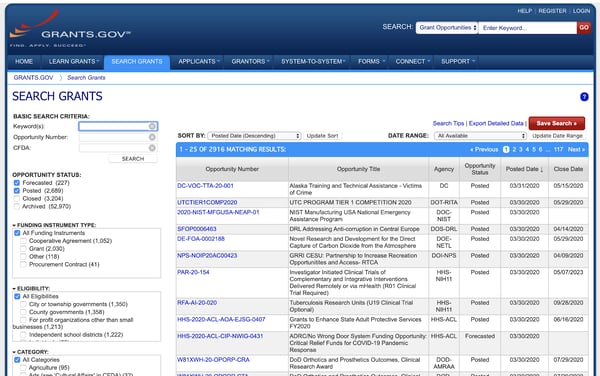

Grants.gov is a comprehensive site that educates grant applicants about funding opportunities and allows them to search a huge catalog of federal, state, and local grants from a variety of different organizations.

While anyone can use the website to find grants for many different purposes, small business owners can filter searches to grants that directly pertain to their company or industry.

Although there are thousands of searchable grants on this database, it's important to note that many of them focus on non-profits, health, education, or public service. Additionally, many of the grants offered are from federal or state-funded organizations. This means that some for-profit small businesses might have difficulty finding grants related to their field.

Private Assistance and Lenders

In the coming months, many private banks will be offering assistance or special funding opportunities for individuals or small businesses. Here's a quick rundown of companies with temporary assistance or ongoing small business loan programs:

JPMorgan Chase's Small Business Pledge

In light of COVID-19, JPMorgan Chase has pledged $2 million to its nonprofit partners around the world and $8 million to "assist small businesses vulnerable to significant economic hardships in the U.S., China, and Europe."

The banking company says they will be working with community development financial institutions around the world that will provide low or zero-interest loans and interest rate buydowns to owners. JPMorgan Chase will also aim to financially help those who've benefited from its Ascend and Entrepreneurs of Color funds.

Along with the aid noted above, Chase and JPMorgan are SBA-approved lenders, meaning they offer many of SBA's low-interest loan options. They also offer real-estate, equipment, and business trade financing to small businesses.

Small business owners can also apply for short-term loans of up to $5,000. These loans have fixed or adjustable rates and can be paid back between one and seven years.

TD Bank Loans and Lines of Credit

TD Bank offers credit lines, loans, mortgages, and equipment leasing to small businesses.

According to TD, credit lines are best for borrowing $25,000 to $500,000. However, larger lines are available for commercial-sized businesses. Interest rates vary based on the credit line. When paying the money back, credit line recipients have the option to pay towards the overall credit line, or just pay interest-only.

When it comes to loans, mortgages, and equipment leasing, TD Bank says it can lend up to $1 million to small business owners. Similarly to credit lines, larger loans are available for commercial companies.

Like many other financial institutions on this list, TD Bank is an SBA lender and also claims to offer competitive interest rates.

Capital One

Capital One is also an approved SBA lender. Aside from SBA lending, Capital One also offers business installment loans. These loans are fixed-term loans of $10,000 or more.

According to Capital One's website, the loans require monthly payments with a max payback period of five years. The company also aids small businesses in consolidating debt, so they only have to pay one lender each month.

Wells Fargo's Small Business Initiative

According to a recent press release from Wells Fargo, the banking chain will soon be offering resources to meet the urgent needs of small businesses impacted by COVID-19.

As part of Wells Fargo's initiative, the institution will dedicate $2 million "to the deployment of flexible capital in collaboration with Opportunity Fund and will also provide immediate cash boosts and financial coaching support of entrepreneurs and their low-wage workers in coordination with SaverLife."

Aside from the initiative noted above, Wells Fargo offers three types of loans: unsecured business loans, Equipment Express Loans, and an Advancing Term loan. The first two loans are aimed at one time projects or purchases.

The loans can be for an amount between $10,000 and $100,000 and have payback periods of one to five years or two to six years respectively. The Advancing term loan is a $100,000 to $500,000 working capital loan which requires business assets as collateral.

The banking institution also offers credit lines between $5,000 to $100,000. Interest rates vary depending on the line. No collateral is required for these lines and all businesses that use them are automatically enrolled in Wells Fargo's rewards program. For larger businesses, which make $2-to-$5-million annually, Wells Fargo also offers a Prime Line valued between $100,000 and $500,000

BlueVine

BlueVine is an organization that provides small businesses with loans between $5,000 and $5 million. Interest rates for loans and credit lines start at 4.8% and vary based on the type and size of loan selected. The company offers three specific types of lending: Credit lines of up to $250,000 with no repayment penalties. term loans of up to $250,000, and Invoice factoring -- a credit line specifically for invoices -- of up to $5 million.

To apply for a BlueVine credit line or loan, you must have $10,000 in revenue and have been in business for more than six months. The business owner must also have higher than a 600 FICO score. Eligibility information is not noted online for BlueVine's invoice factoring service.

Once an application is submitted to BlueVine, the lender could respond within five minutes or 24 hours.

Funding Circle

Funding Circle offers small business loans between $25,000 and $500,000. Loans are fixed term and can have a payback period between six months and five years. Interest and origination fees might vary based on the type and size of the loan.

The company says that loan applicants will receive a decision within 24 hours of applying. According to its website, Funding Circle also provides loans for female entrepreneurs, minorities, and small business acquisitions.

Funding Circle is also an SBA-approved lender. According to its website, it will soon be offering loans funded by the Paycheck Protection Program, noted in the CARES Act.

Small businesses that are interested in working with this company to receive Paycheck Protection Program loans can sign up to receive email notifications when applications are launched specifically for it.

It's important to note that certain Funding Circle loans require a one-time fee before they're dispersed. When an applicant is approved for a loan, they'll receive the fee and interest information before being required to commit to the loan.

To receive a loan from Funding Circle, business owners must have an Experian credit score of 660. Additionally, businesses in some industries are ineligible for term loans. These industries include speculative real estate, nonprofit organizations, weapons manufacturers, gambling businesses, and marijuana dispensaries. They also cannot provide loans to businesses in Nevada due to the state's lending regulations.

PayPal Business Loans

PayPal offers small business loans between $5,000 and $500,000 to companies that have been in business for nine months or more and have a free PayPal Business profile.

According to PayPal's site, no interest is due on the loan if it is paid back within the first six months. The amount of interest and payback period varies based on the type of loan businesses apply for.

To receive a PayPal loan, businesses must be more than nine months old, earn $42,000 annual revenue, and not have any active bankruptcies. Any business owner in the United States can apply for a PayPal loan, but they must have a FICO score of at least 550. Like Funding Circle, PayPal notes that some industries are ineligible for business loans.

Citi Fee Waivers

For retail customers and small business customers, Citi has waived fees on certificate of deposit withdrawals until May 2020. For small businesses, Citi will also provide waivers for monthly service fees and remote deposit capture.

Additionally, those with a Citi credit card might qualify for a forbearance program which would delay them from needing to pay back their full balance.

State and Local Funding Resources for Small Businesses

State-Funded Programs

Each state offers different benefits, tax exemptions, loans, or grant opportunities for businesses. To learn more about state-based assistance and funding, visit your state department's website.

For example, small business owners in Massachusetts can visit mass.gov to find information about state-mandated COVID-19 relief. On this page, you'll find information about Massachusetts' own relief funding, as well as federal loan options.

Additionally, you can also check out the grants.gov database or this interactive map that allows you to see assistance opportunities by state.

Local Banks and Credit Unions

While many big banks are currently offering loans related to the financial climate, your local bank or smaller chains might also be allowing small business owners to take out loan amounts with interest rates and payback periods that work for them.

Tips for Picking the Right Funding

While the CARES Act and private business initiatives have opened the door to a number of financial opportunities for businesses, there are still a few things small business owners should keep in mind.

First, it's important to note that some of the loans above might come with fees. For example, you might have to pay a small fee to disburse the loan in the first place.

Secondly, some of these loans do not disperse all at once. For instance, loans of up to $10 million designated by the CARES Act will offer small businesses a cash advance of up to $10,000 before the rest of the funds are dispersed.

Before committing to a loan, small businesses might need to look at their timeline for paying bills and other expenses and make sure that a loan's disbursement works for them.

Lastly, and most importantly, when accepting a loan, a small business owner agrees to pay it back.

While some loan programs are currently offering deferment or partial forgiveness programs, most will expect all the funds plus interest to be paid back. As business owners research these loans, they should fully understand the payback and interest rate terms before committing. They should also have a financial plan and backup plan for how they will pay off the loans and interest in the future, regardless of whether their business is or is not running.

Disclaimer: This blog post is meant as a basic resource and not a comprehensive guide. We will regularly update it to add more information as funding opportunities become available or change.

No comments:

Post a Comment