The economic impact of COVID-19 is undeniable. Businesses all across the globe are learning how to adapt to these new circumstances and we're all learning how to operate in a "new normal" that's constantly changing.

That's why we'll be publishing week-over-week trend data for core business metrics like website traffic, email send and open rates, sales engagements, close rates and more. We hope to establish useful benchmarks to measure your business against, and serve as an early indicator of when short- or long-term adjustments may be needed in your strategy.

While this post focuses on the highlights of last week, you can explore all the data we're publishing here.

About the Data

- These insights are based on aggregated data from over 70,000 HubSpot customers globally.

- The dataset includes weekly trend data for core business metrics in 2020, focusing on changes occurring during and after March 2020.*

- The data from HubSpot's customer base reflects benchmarks for companies that have invested in an online presence and use inbound as a key part of their growth strategy. This data

*The spread of COVID-19 has had a different timeline in different regions, so we are using the World Health Organization's declaration of a global pandemic on March 11, 2020 as our "official" start date.

NOTE: Because the data is aggregated from HubSpot customers' businesses, please keep in mind that individual businesses, including HubSpot's, may differ based on their own markets, customer base, industry, geography, stage, and/or other factors.

What We're Seeing

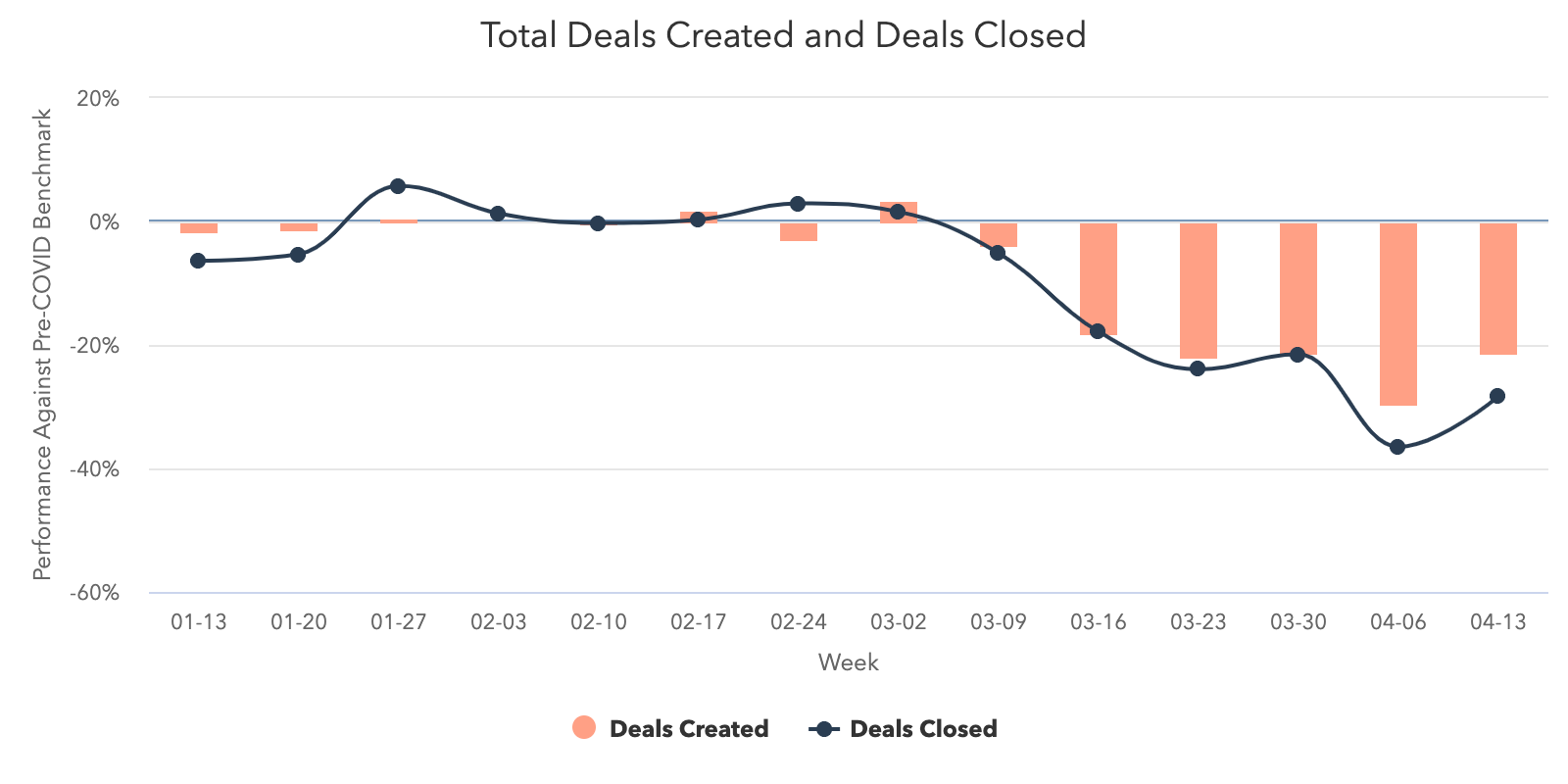

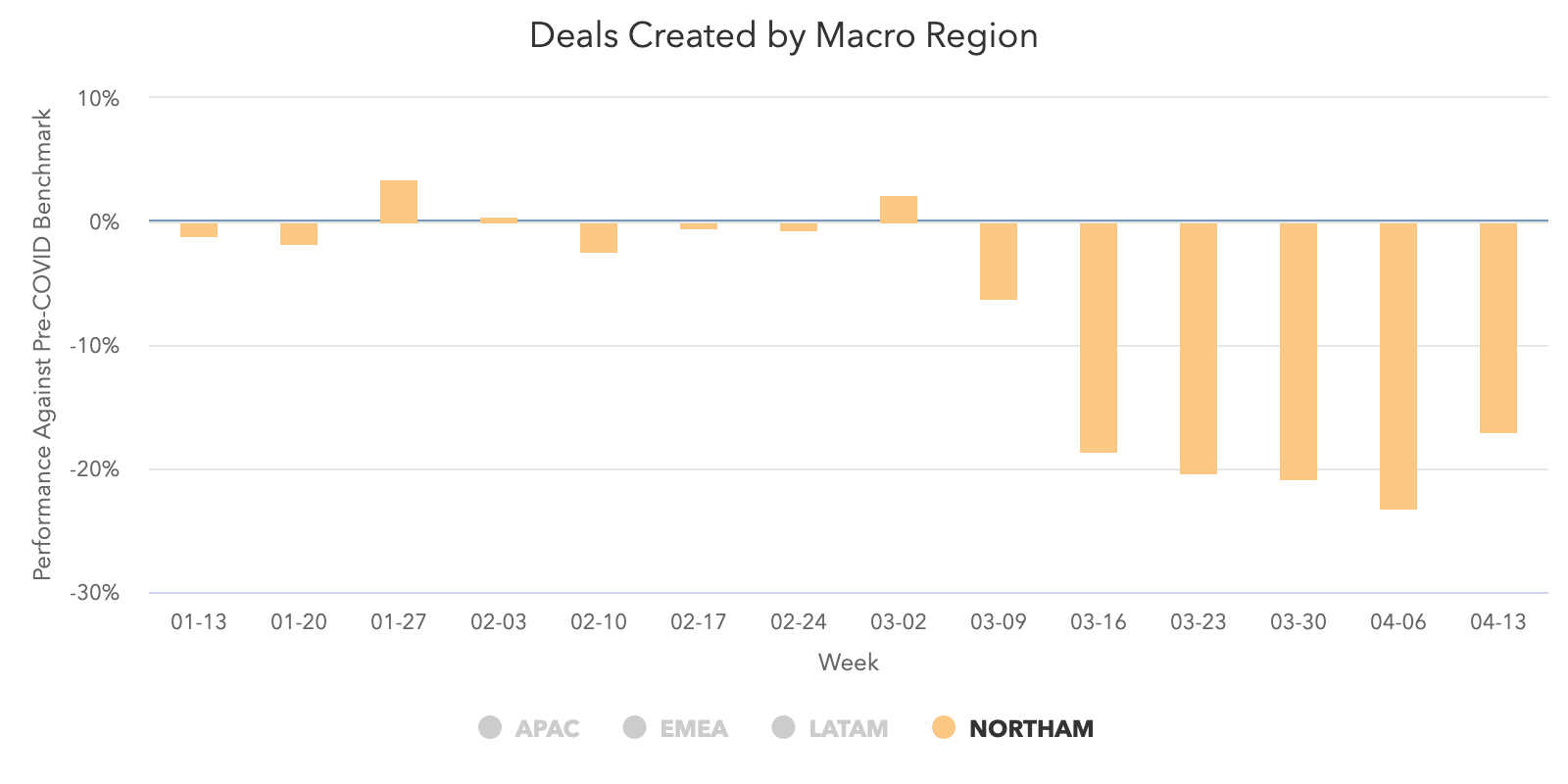

After multiple weeks of decline, last week saw a positive uptick in the number of deals created in HubSpot CRM as all global regions reported a rise. This is an important metric for business owners as deal creation is an indicator of future revenue. While this metric is still down 21% compared to pre-COVID levels, this week was a small victory after seeing negative results over the past several weeks.

Deals marked closed-won rebounded as well after experiencing a significant decline the week of April 6. This indicates that while sales teams are still figuring out the most effective ways to engage consumers, they're starting to show signs of recovery after hitting roadblocks in mid-March. This metric is still down 28% from pre-COVID levels, so we'll keep a close eye on it to see if a positive trend emerges moving forward.

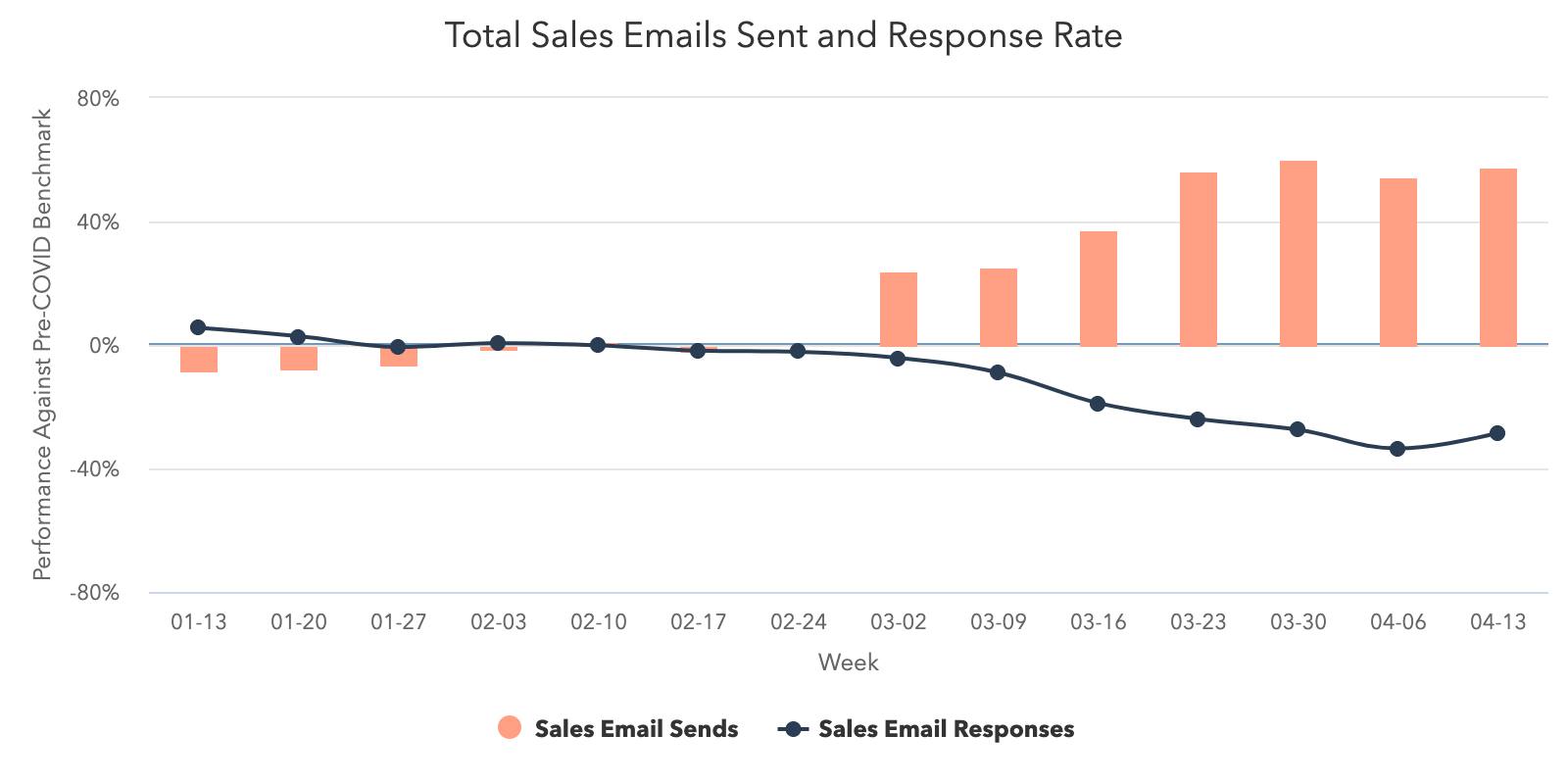

Another bright spot for sales teams last week was email. Both sales sequence send and response rates increased week over week with response rates rising 8%. While it's too early to call this a definitive upward trend, it's a promising sight after a few weeks of continuous decline.

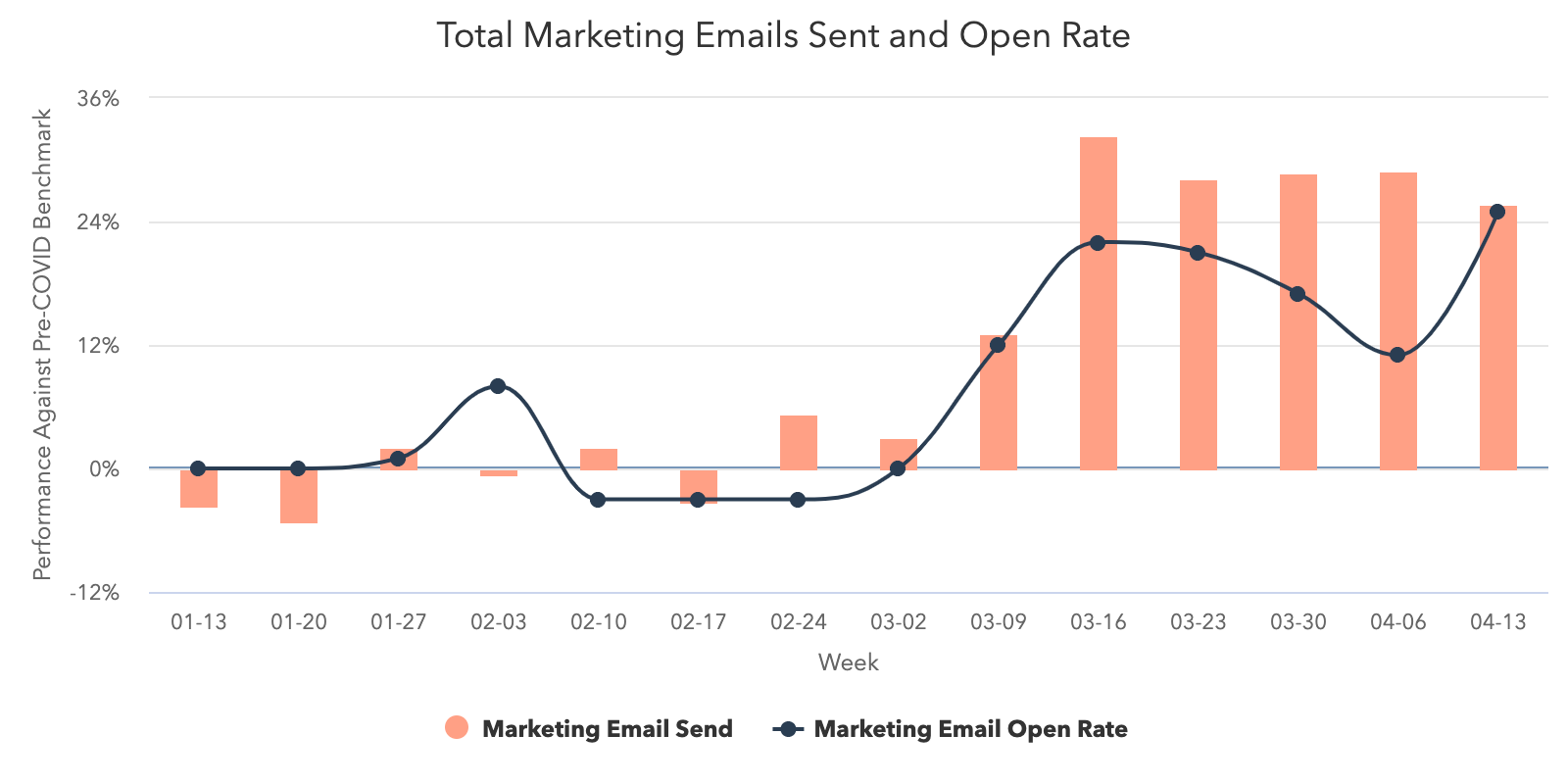

Consumers are still engaging with marketing channels as open rates continued to rise last week. In fact, open rates were 25% higher than averages taken during pre-COVID levels. Marketing teams are finding new ways to interact with customers and email appears to be an effective medium for attracting qualified leads. Even though send rates and contact creation dipped slightly, engagement continues to be high as people seem particularly responsive to email marketing.

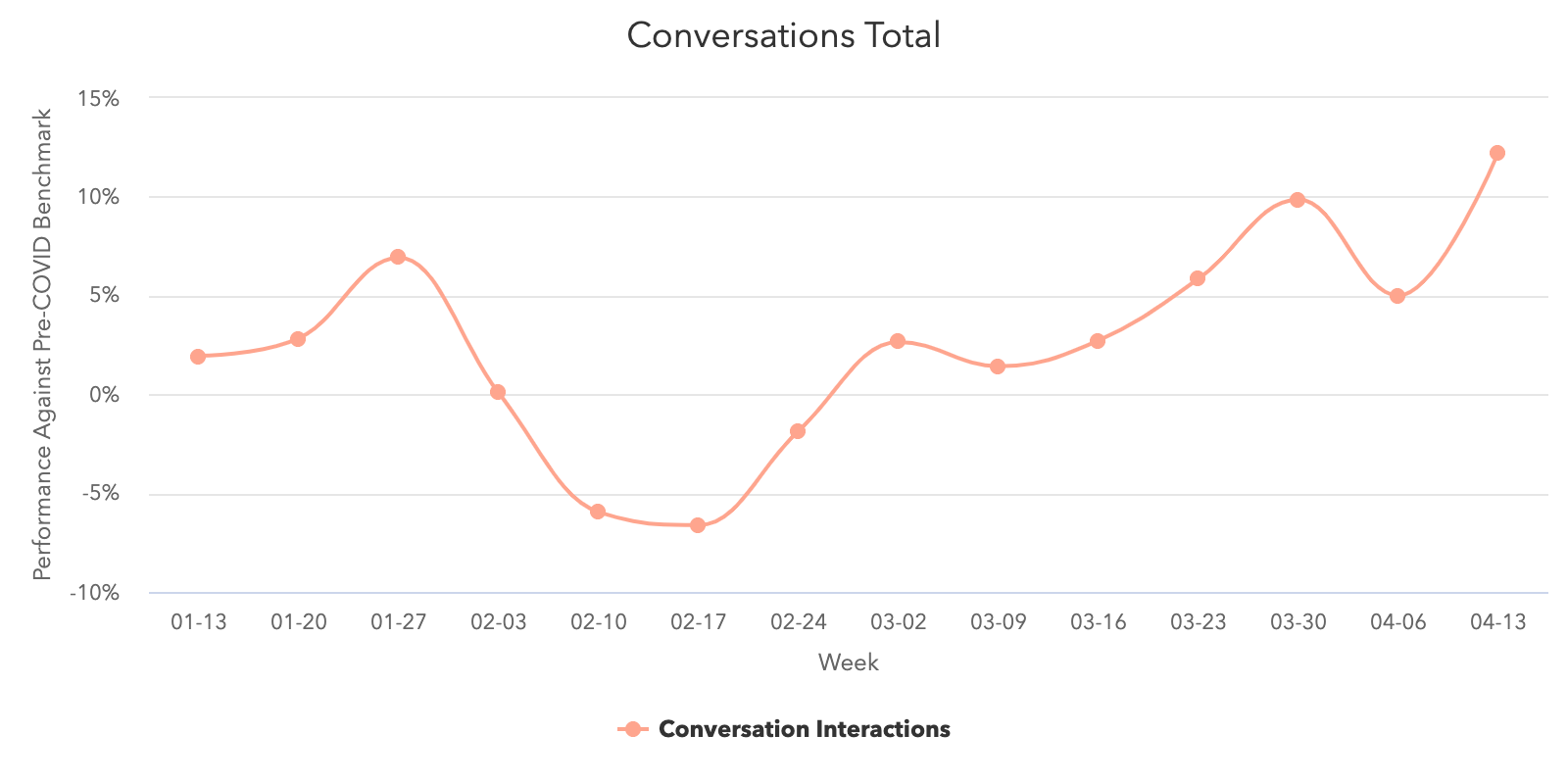

Similar to email, live chat is another channel that consumers are favoring when interacting with businesses. Last week, chats initiated in the HubSpot CRM increased 7% across all global regions. This is a nice rebound from the week of April 6 as chat volume continues to rise far above pre-COVID averages.

To add more context to this data, we added an employee-size breakdown based on the number of employees that each HubSpot customer has. Similar to previous weeks, business-size doesn't seem to play a major role as companies of all sizes seem to be equally affected by this environment. While we'd anticipate larger businesses would be better equipped to handle these challenges, nothing in our data definitively confirms this.

If you'd like to see more of what we're measuring, you can explore the entire dataset here.

How Metrics Changed in April

The number of deals created and deals closed-won increased.

After a drop the previous week, deals created and deals closed rebounded with a stronger performance during the week of April 13. Deals created increased by 9% and deals closed increased by 13%. This is a notable jump from the week of April 6 when deals closed reach its lowest weekly volume this year.

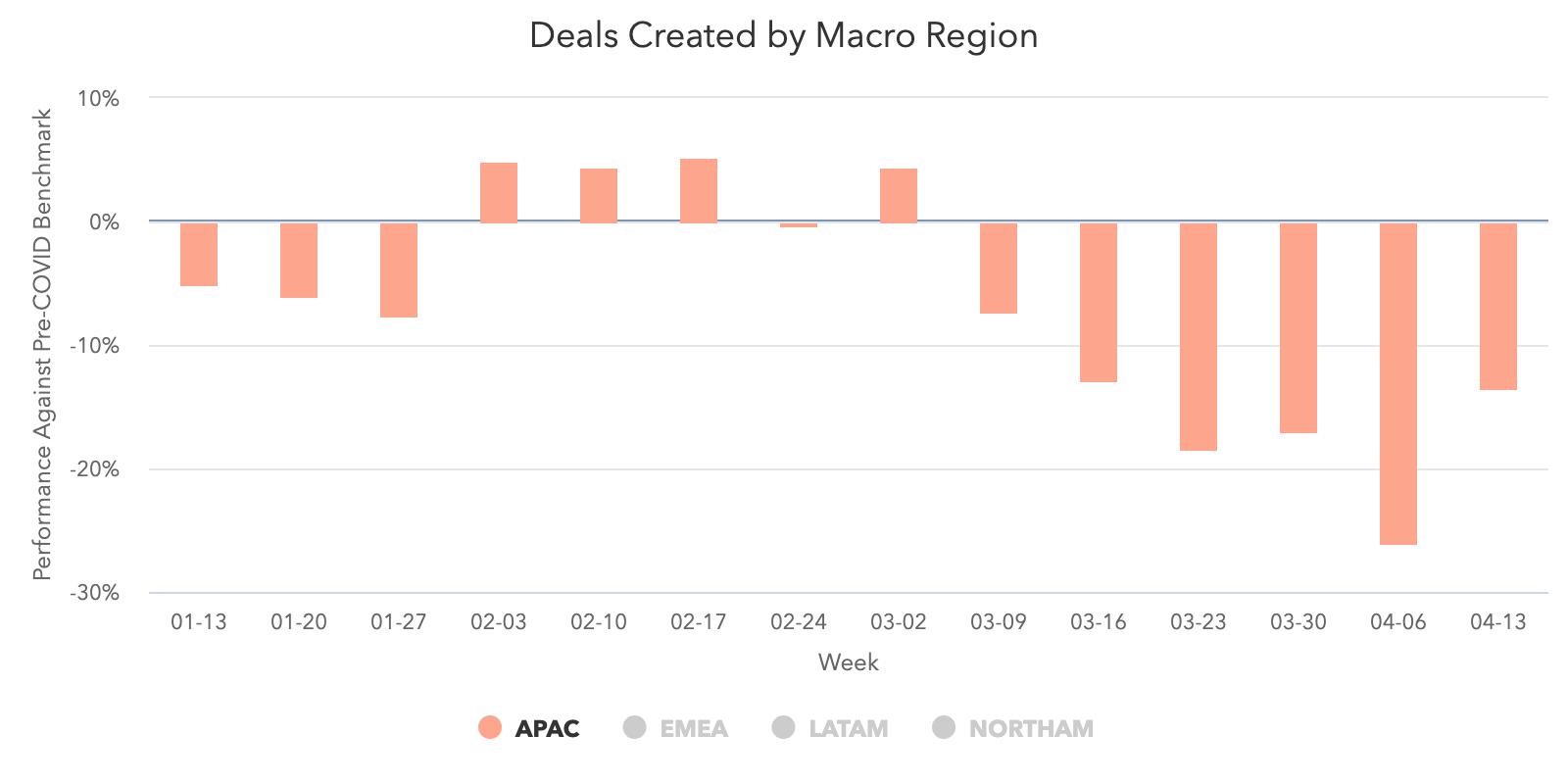

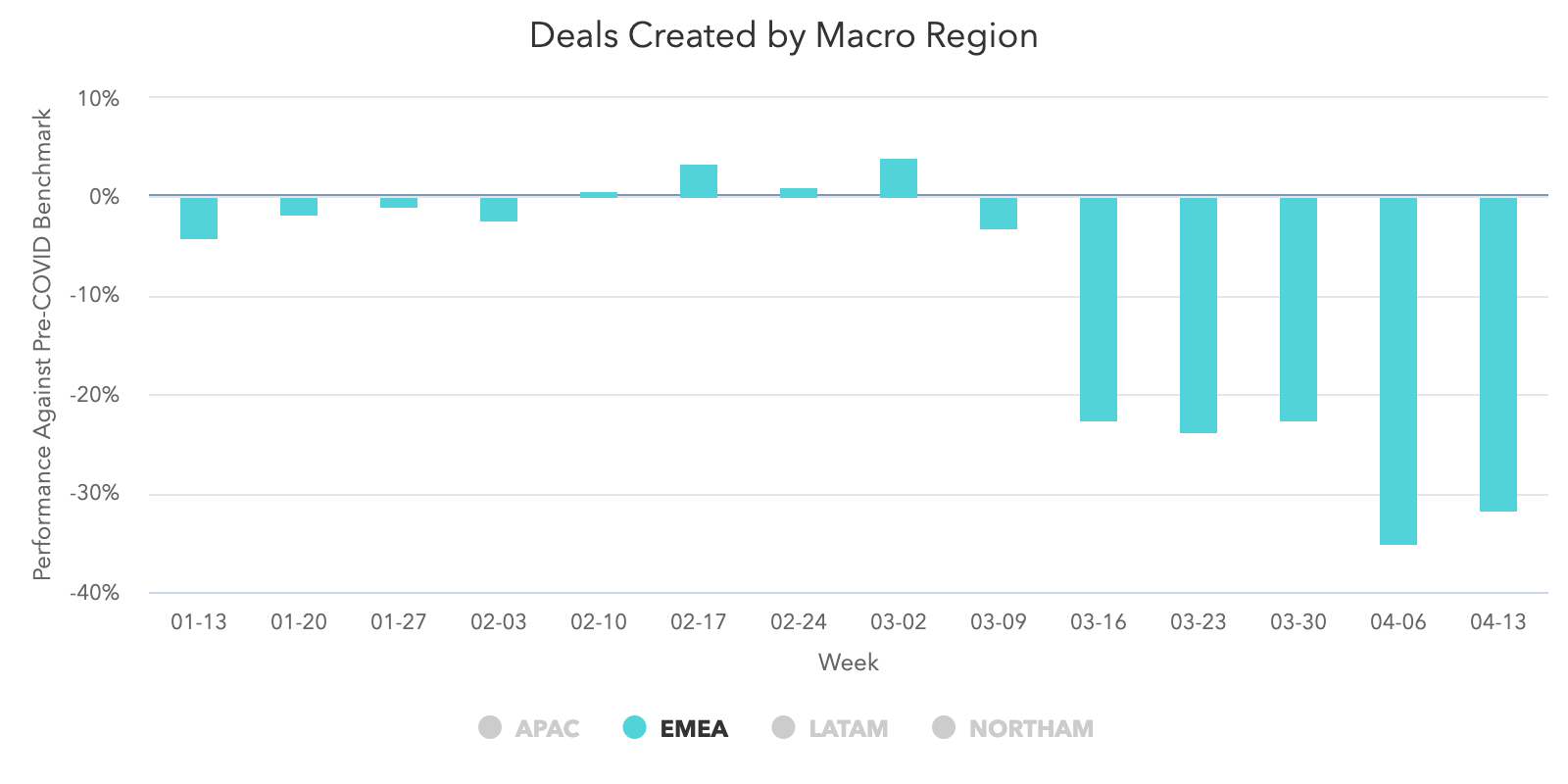

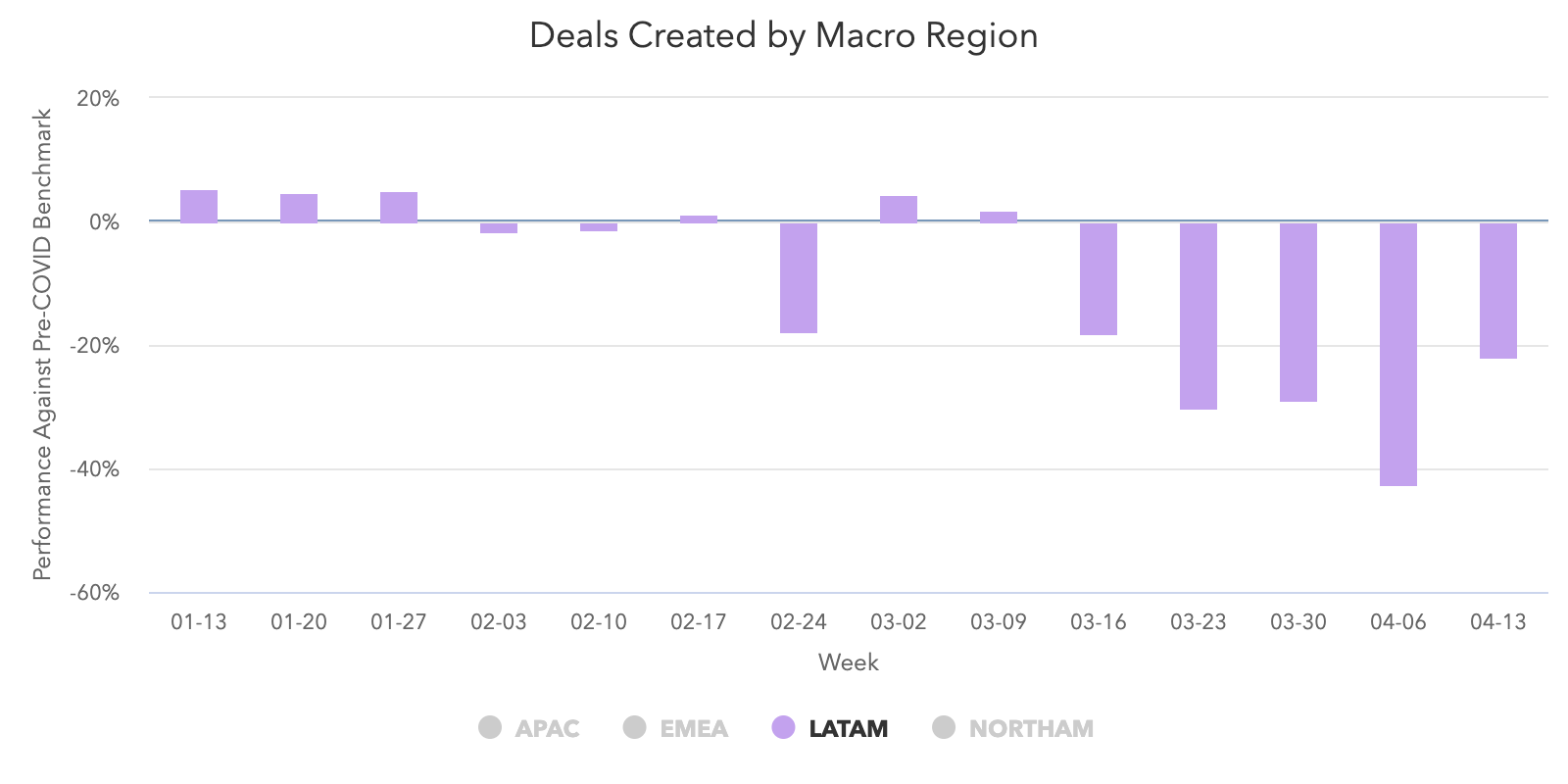

After the dip during Easter weekend, deal creation is up in every region. LATAM and APAC had the highest increases with 33% and 11%, NORTHAM with 5%, and EMEA saw the smallest increase at 1%.

Both sales email volume and response rates increased.

Sales email volume continues to reach historic highs as total sequence sends rose again last week. Total sequence sends increased by 2% and are trending 50-60% higher than they were during pre-COVID levels.

The good news is response rates are up as well. Response rates rose to 2.3%, which is an 8% boost from the previous week.

While sales email volume is still higher than pre-COVID averages, response rates are still catching up to those levels.

Marketing email open rates increased as volume declined slightly.

Like many people, you may be noticing a few more marketing emails in your inbox lately. Marketers are sending a lot of emails during this crisis, and the good news is that readers are opening them at record rates. Marketing email engagement rose again last week as open rates climbed to 25% higher than pre-COVID averages — roughly 5% higher than the week of April 6. And, while send volume decreased by 3% last week, it's still trending well above pre-COVID averages.

Customer-initiated chat conversations continue to rise.

After a slight dip, chat conversations have increased 7% from the week of April 6. With the exception of that week, this marks the fifth consecutive week where chat volume has grown. In total, customer-initiated conversations have increased 9% since the week of March 9.

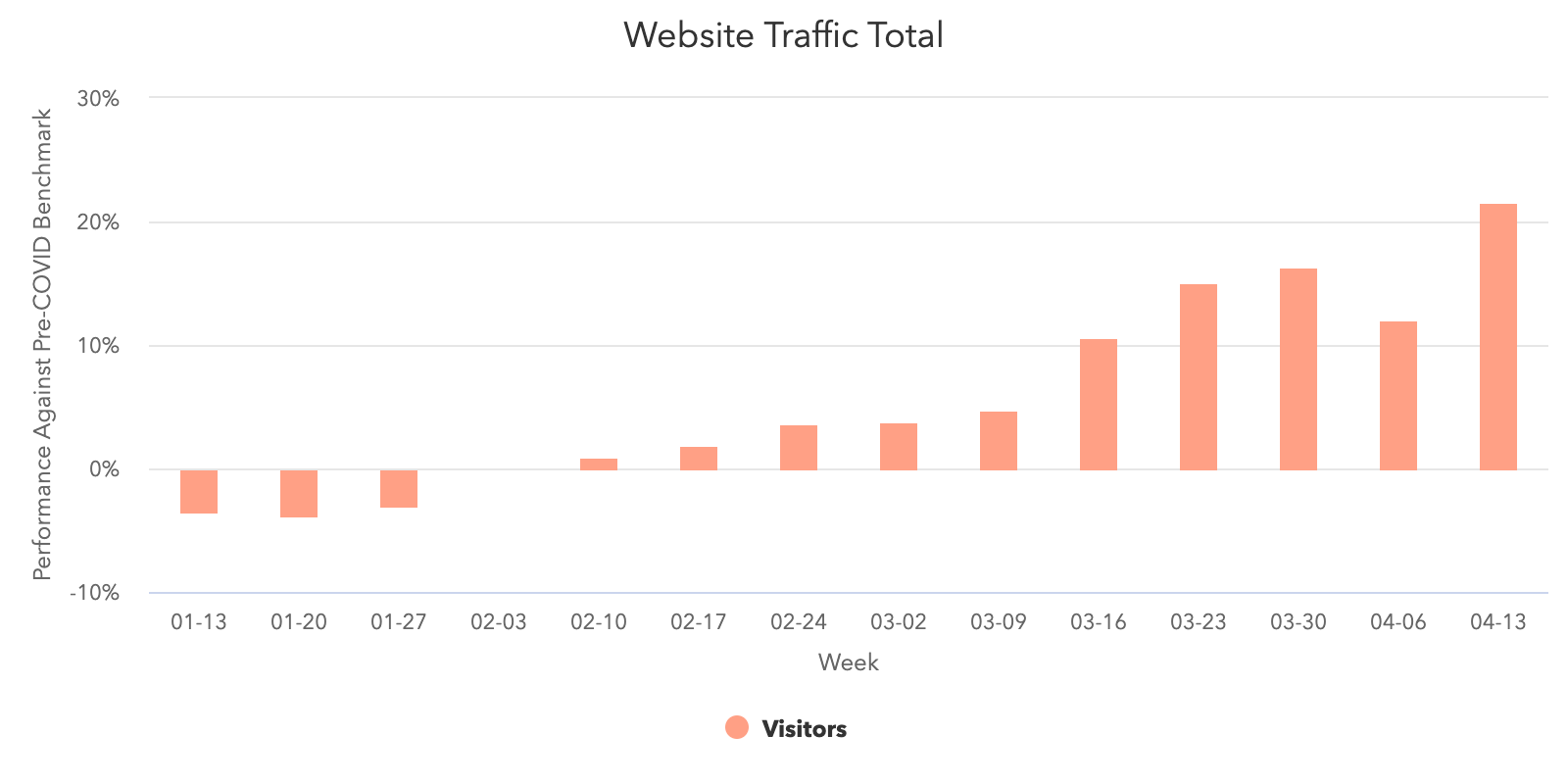

Website traffic and database growth has slowed, but is still at or above pre-COVID levels.

Two weeks ago, the average number of contacts added to portals dropped by 19% after dropping another 36% the week of March 30. Last week, that number stabilized with the average number of contacts decreasing by 3.2%. While this may seem like another week of decline, this number is staying on pace with the weekly averages observed in February.

Web traffic declined last week dropping 4.4% the week of April 13. Despite this dip, web traffic continues to be trending above pre-COVID levels, so we'll look for a bounce back next week.

What This Means for Businesses

Create an educational content strategy.

The increase in marketing email open rates suggests that customers are still looking to engage with companies. While people still need to buy products, marketing teams should be adapting their strategies to focus on learning and education.

At HubSpot, our blog and HubSpot Academy sites have seen significant traffic upticks since pre-COVID levels. Traffic to our Academy site has more than doubled since March 8 and our Marketing Blog alone has experienced a 40% rise in weekly organic traffic volume during the same period.

Instead of dialing up the promotion of your products and services during a crisis, focus on nurturing the long-term relationship. Identify where you can help your customers today, without asking for anything in return.

Resources to Help

- Use this guide to develop a start-to-finish content marketing plan

- Learn how to plan a long-term content strategy with this HubSpot Academy course

- Discover more reasons why you should create a customer education program

- Get your content found on search engines with this search insights report course

Free Software to Get Started

Focus on inbound sales.

With database growth remaining fairly consistent with February averages and email marketing open rates rising significantly since pre-COVID levels, Inbound strategies are becoming more valuable. Marketers are still attracting qualified leads, but sales needs to adapt and pivot to fully capitalize on these opportunities.

Operationally, your business should regularly adjust its sales projections to reflect potentially extended sales cycles or lower deal size so forecasts remain accurate. Just a touch of process (or improvements to existing processes) goes a long way in creating a clear picture of your business over time.

On individual calls, encourage your team to emphasize a helpful, consultative selling approach. Certain factors, like your customers' budget and willingness to enter sales conversations, are out of your control. Instead of cold calling your whole database, prioritize your outreach based on industry. For example:

- Industries that have been minimally impacted or those that are transforming quickly to meet the new challenges

- Industries where your solutions are particularly relevant or useful in this moment

Additionally, not every call should be an upsell. At this time, your sales team should be embracing empathy and putting your customers first. Instead of calling a customer to make a sale, check in on how they're doing and see if you can provide any further support.

We hope to see sales outreach trend down toward pre-COVID levels accompanied by even higher response rates in the next few weeks. This would indicate that companies are doing a better job of targeting buyers who have shown genuine interest in their products.

Resources to Help

- Read about what companies are doing to pivot due to COVID-19

- Rework your sales projections with this guide to sales forecasting and sales forecast template

- Maintain an accurate forecast with this sales pipeline tracker

Free Software to Get Started

- HubSpot CRM is free and comes with included sales acceleration tools

- Gmail and Google Calendar integrations with HubSpot

- Zoom integration with HubSpot

- LinkedIn Sales Navigator integration with HubSpot

Incorporate email and live chat into your strategy.

Whether it's for sales or marketing, email is proving to be an effective channel for customer communication. Marketing emails are experiencing particularly high open rates and sales email engagement is showing signs of recovery. While businesses should be mindful of overloading their customers' inboxes, right now email is one of your most reliable options for customer interaction.

Another effective medium is live chat. Chat volume grew once again last week and has propelled far past pre-COVID averages. As consumers become more comfortable operating in a digital landscape, it's expected that they'll turn to your website's built-in channels for support — e.g. email and live chat.

Conversational marketing offers a real-time way to answer customer questions and automates the lead routing process so your business can serve prospective and existing customers even when your team is out of the office. Additionally, chatbots can help your company meet the increase in inquiries by providing customers with lightning-fast answers, automating lead qualification, and booking meetings on behalf of your sales and service teams.

Resources to Help

- Get up to speed with this beginner's guide to conversational marketing

- Learn how marketers are using conversational marketing in 2020

- Get your sales teams started by learning how to add live chat to your website.

Free Software to Get Started

- Free conversational marketing tools are included in HubSpot CRM

- Facebook Messenger integration with HubSpot

We hope these benchmarks provide useful context as you monitor your business' health in the coming months. We plan to refresh these insights and add further breakdowns over time (such as by channel and company size). You can sign up to be notified of new insights as they're available here.

No comments:

Post a Comment