It's surprisingly inexpensive to start a business today — as little at $5,000, reports Fortunly. However, as encouraging as that is to aspiring business owners, the costs to run that business every day are a bit more complex.

Before research and development, and before you even rent an office space, you might want to know how much money you'll need to make your product. These are your direct costs.

What are direct costs?

Direct costs are what you spend specifically to develop and maintain your product or service. These costs can vary over time as the product is improved upon. Direct costs range from employee salaries to the price of the items needed to build each unit of your product.

Direct cost is particularly important to factor in when setting the price for your offerings because it acts as the minimum amount to break even on production. From the break-even point, you can determine the margin you need to cover your business's indirect costs (overhead) and turn a profit.

Increases in direct cost can be caused by increases in material or manufacturing costs, lowered production efficiency or delays, and other similar issues. For this reason, it's a good to have a finger on the pulse of your direct costs as an indicator for preempting major problems.

In addition, direct cost can help managers determine if new products or projects are profitable and whether it's more viable to outsource or tackle in-house.

Are direct costs different from fixed and variable costs?

Actually, direct costs are a type of fixed or variable cost. These expenses are not mutually exclusive. Whether or not a direct cost is fixed or variable simply depends on how likely (or regularly) the cost is to change as your business grows. Here are two examples:

- Variable direct cost: A SaaS company that sells cloud-based software is responsible for storing the data their customers put on their software. That information is stored on servers. The more clients the company has, the more servers the business will need to buy to store client data so the product can continue to operate. Server costs, in this case, are a variable direct cost to the business.

- Fixed direct cost: Consider the variable cost example, above. This company also employs an IT administrator to manage the storage of its customers' data. Barring changes to his/her compensation, the salary the company pays this administrator remains unchanged each month. IT salaries are a fixed direct cost to the business.

Direct vs. Indirect Costs

Direct costs are invested "directly" in the development of a product or service. Indirect costs may affect the business's overhead, but they do not directly contribute to the creation and quality of that service. These costs include office space rent, office security, and staff supplies.

Direct costs get their name because they have a "direct" line to the creation and management of your goods and services. You pay cost A in exchange for item B, you use item B to make product C. Cost A is a direct cost because product C can be traced back to the cost A you paid.

Indirect costs are more complicated and do not have this direct line to your product's end result. You pay cost A in exchange for facility B, you use facility B to host machine C, machine C is used by team D to make product E. Cost A is an indirect cost because product E cannot be directly traced back to the cost A you paid. There are other direct costs that took place between A and E.

Examples of Direct Costs

- Physical materials

- Employee salaries

- Sales commission

- Servers

- Data center space

- Product transportation

- Power

It's easy to attribute your direct costs to the money you spend physically making your goods and services. An automotive company, for example, might pay a steel manufacturer for the material used to create each car body. This is a direct cost to the car company.

However, there are other direct costs that can go into a product even if those costs don't pay for the material your product is made out of. Here are some common examples of direct costs you can attribute directly to your product:

1. Physical materials

The raw materials, ingredients, and parts needed to build your product are all direct costs to your business.

For example, if sell computers, you'll need to factor in the materials needed for the screen, the keyboard, and the hard-drive, as well as any other material needed to build the device when designating a cost for it.

2. Employee salaries

The individual salaries, particularly the ones you pay to those who make and sell your product, are direct costs.

If you hire any freelancers or contractors, you'll also want to factor in how much money you will need to spend on their labor.

3. Sales commission

This is different than salary and is usually specific to salespeople, which often work partially on commission.

Every time a salesperson sells a unit of your product, he/she is paid commission. This is a direct cost to maintaining the value or your product. Compare how many units you'd like to sell with the commissions you'll pay every time they get sold.

4. Servers

In 2020, almost every business needs some sort of a website. Meanwhile, every website needs a server. The servers needed to store customer data on your product, particularly if your product is in the form of software, is a direct cost to your business.

While you might be able to trim down costs buy building your website on a CMS that provides server support, you should still factor in the costs you'll need to protect and store your data.

5. Data center space

Just paying for your servers isn't the only thing you might have to factor in. You also might need to consider where you'll place them and how much that could cost. Data center space you rent or own to store those servers is a direct cost.

6. Product transportation

Once a customer buys a product, how will it get to them? Will it come in the mail, or will a delivery tech from your company bring it? You'll need to determine which strategy you'll use and add up the costs associated with that. While mail will result in regular shipping costs, having your own company deliver it will results in costs of labor and costs related to purchasing your own modes of transit, such as trucks.

7. Power

Electricity or fuel consumption is an example of a cost that could go in either the direct or indirect cost bucket. On one hand, the entire business (including the indirect functions of the business) consume power, so unless you're splitting how much goes to direct production vs. indirect functions, it's best left as an indirect cost. However, you might be able to do that attribution easily if arms of your business operate in different facilities or use different types of power.

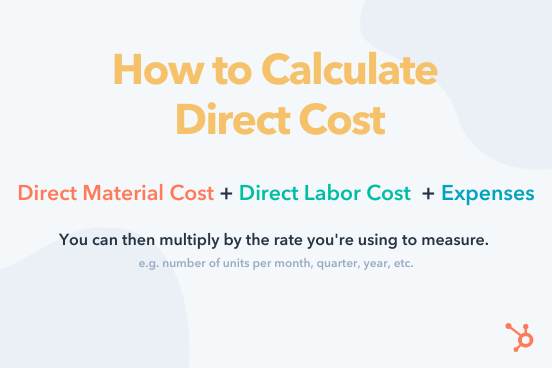

How to Calculate Direct Costs

Direct Material Cost

This is the amount of materials that are needed to produce the item or complete the project. Add up all the materials that go into the production of a single unit.

Direct Labor Cost

This is the amount of labor that is required to produce a the item or complete the project. List all the employees that contribute directly to the production of a single unit. Then, determine how much time each of them is expected to put into producing a single unit. From there, you can use their salaries to determine the labor cost of a unit.

Other Expenses

Use the list above to determine other expenses that might directly contribute to production.

You might choose measure direct cost on a monthly basis by taking the cost to produce a single unit and multiplying that figure with the number of units you intend to produce per month. Or you could analyze on a quarterly or yearly basis. Just be sure that you're comparing apples to apples in terms of how you're measuring material cost, labor cost, and other expenses in this regard. You don't want to add a monthly figure with a quarterly figure, for example, because that will throw your calculations off.

By understanding your direct and indirect costs (overhead), you're well on your way to creating a pricing structure and turning a profit. These are important components to your business plan as you determine how to operationalize and grow.

Editor's Note: This blog post was originally published in March 2019, but has been updated for comprehensiveness.

No comments:

Post a Comment